The Toronto real estate market initially started 2025 with a renewed sense of activity, as buyers who had been waiting on the sidelines began re-entering the market. Showings and general interest increased, and the freehold market was particularly active, signalling optimism in the sector.

MARKET PERFORMANCE OVERVIEW

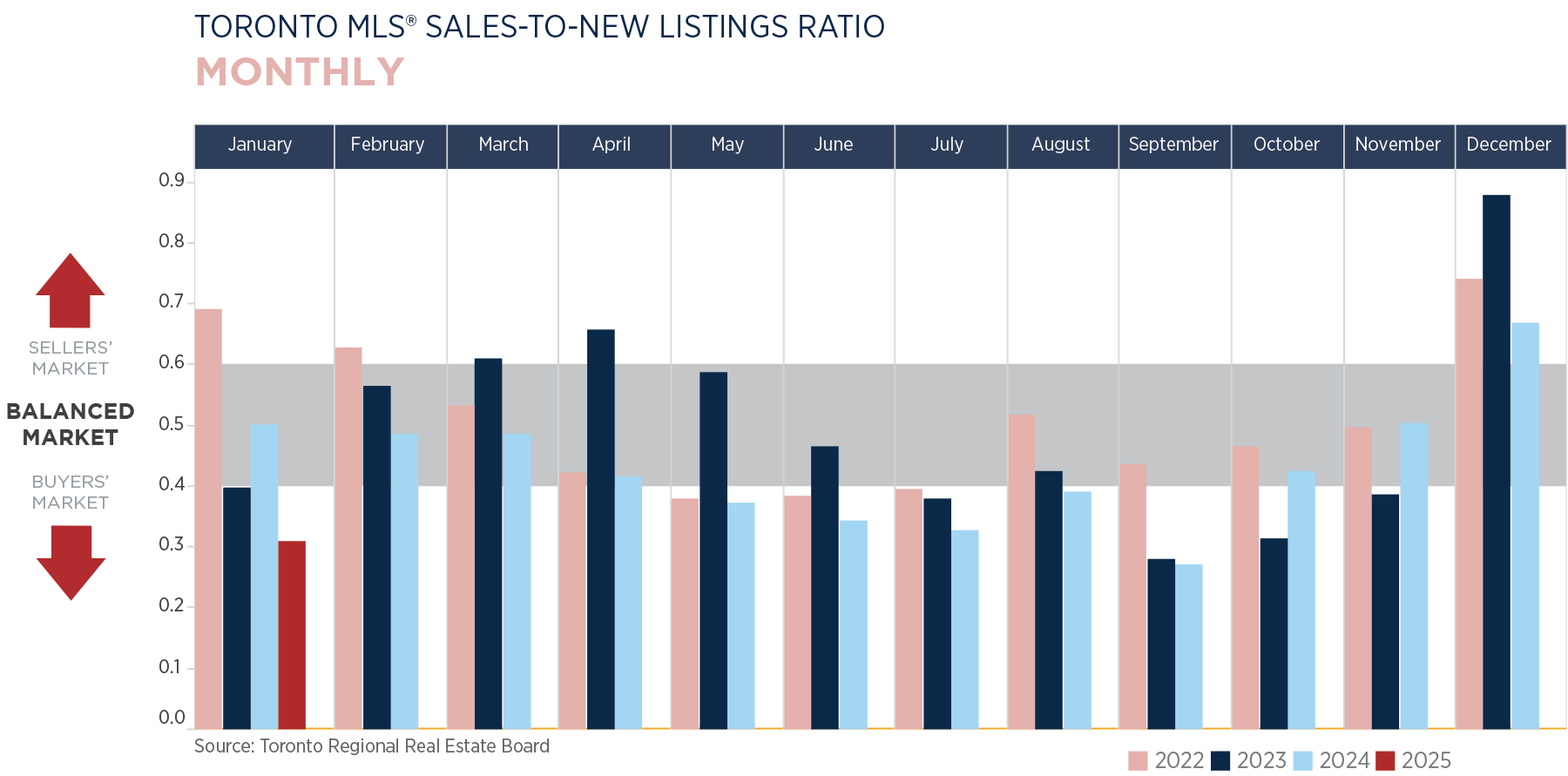

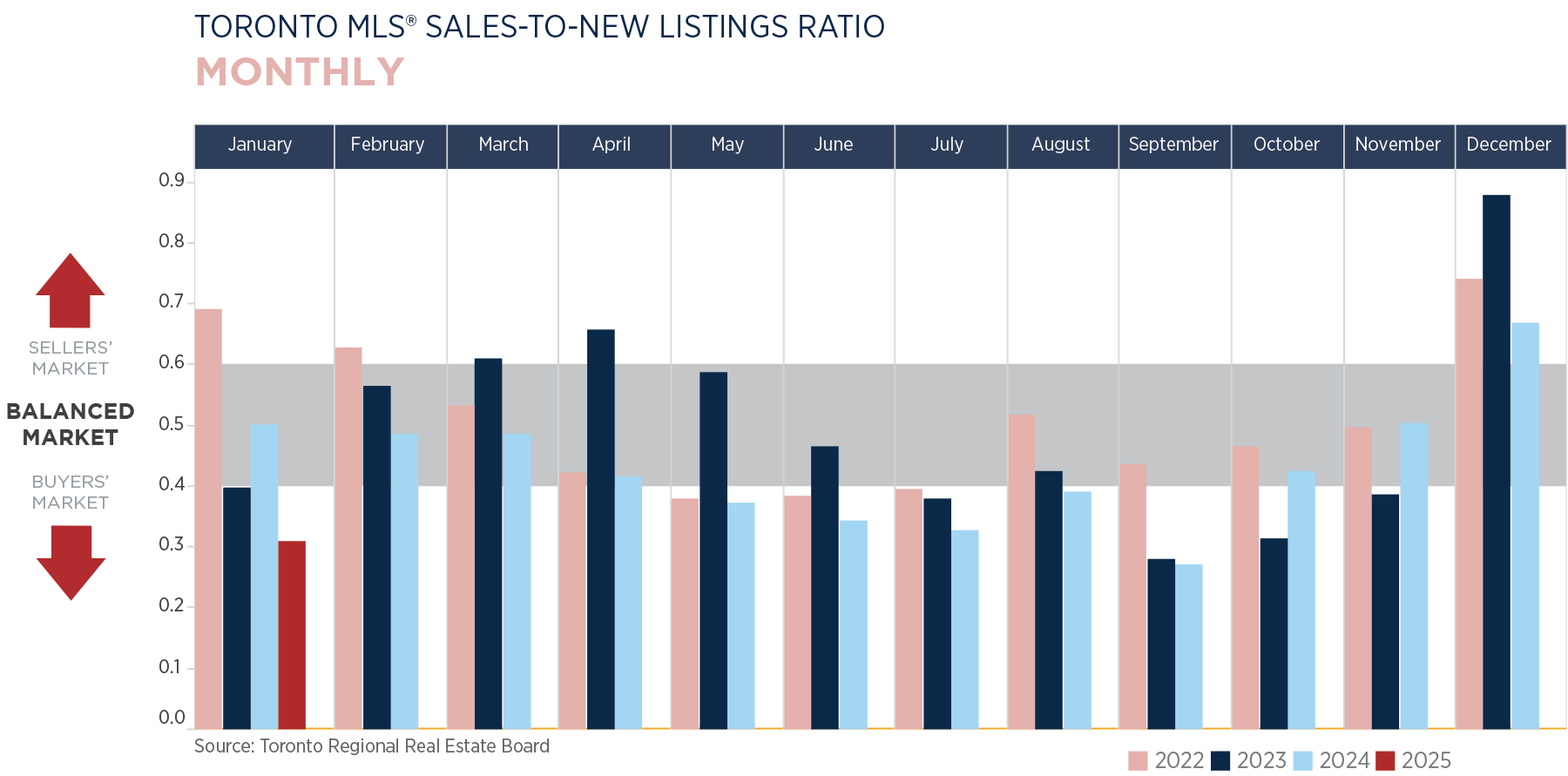

GTA REALTORS® reported 3,847 home sales through TRREB’s MLS® System in January 2025, marking a 7.9% decline compared to January 2024. However, new listings surged by 48.6% year-over-year, reaching 12,392. On a seasonally adjusted basis, sales in January increased compared to December 2024, showing early signs of market momentum. The MLS® Home Price Index Composite benchmark rose by 0.44% year-over-year, and the average selling price stood at $1,040,994—up by 1.5% from January 2024.

As we approach the 2025 spring market, renewed optimism and the benefits of lower mortgage rates were quickly offset by economic uncertainty stemming from trade disruptions and the back half of January felt the impact on consumer confidence.

FREEHOLD MARKET

Freehold properties—including detached, semi-detached, townhomes, and row housing—remained the most sought-after and expensive segment in the GTA. Due to a shortage of newly built freehold properties, buyers are increasingly purchasing and revitalizing smaller homes, leading to a trend of renovations, additions, and complete rebuilds. This dynamic is expected to continue to push lower-rise home prices higher, making them increasingly out of reach for first-time buyers

The recent U.S. tariff announcement has introduced economic uncertainty, despite a negotiated 30-day reprieve. Employment instability and broader economic concerns have led some potential buyers to begin delaying purchasing decisions. Additionally, the OSFI mortgage stress test is now widely seen as outdated, unnecessarily limiting qualified entry-level buyers from homeownership. Removing the stress test will greatly assist in buyer confidence.

CONDO MARKET

A major challenge in the condo market is the disconnect between unit size and buyer demand. The market is oversaturated with smaller units, while the demand for “missing middle” housing—mid-sized condos suitable for urban families—remains high.

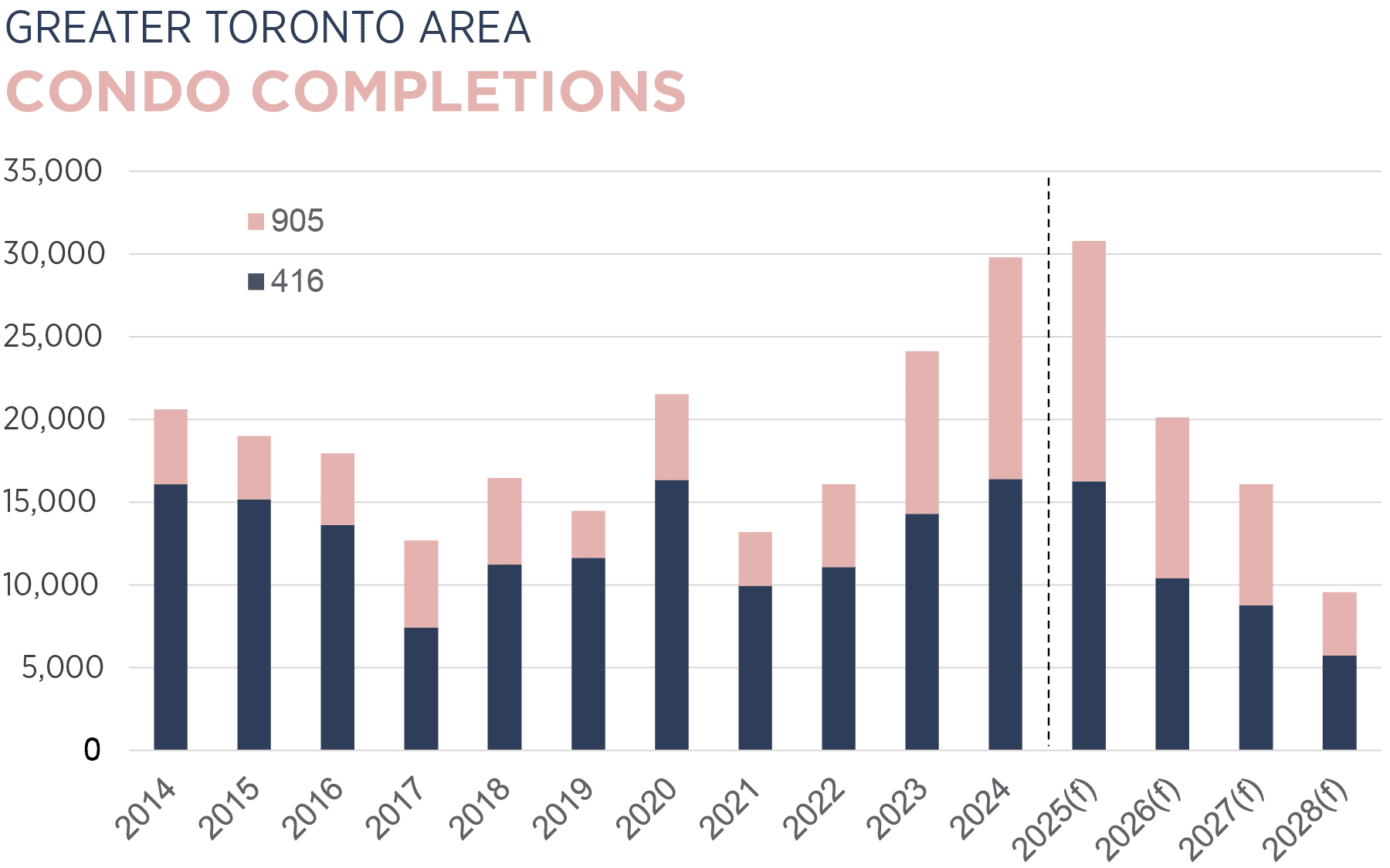

Investors facing cash flow challenges may choose to sell, creating the opportunities first-time buyers have been waiting for and enter the market at a more affordable price point. While these units are compact, they provide a crucial stepping stone for new buyers to build equity and eventually move up in the housing market. The climate for condominiums has shifted considerably due to declining pre-construction starts and an increase in failed transactions. Assignment sales have continued to rise as a result, with developers pivoting away from new condominium projects and focusing instead on purpose-built rentals. This shift could further impact supply dynamics and pricing trends in the condo segment moving forward.

RENTAL MARKET

With more preconstruction completions coming in 2025, it is anticipated that there will be more units coming to the rental market. This inventory rise will continue to place downward pressure on rents, especially in seller units. The increased availability of rental properties will provide relief to tenants who have faced high rental costs in recent years. Additionally, landlords with investor-held units may find it challenging to maintain previous rent levels, leading to potential price adjustments and greater affordability in the rental sector.

OUTLOOK FOR 2025

Looking ahead, market conditions suggest a gradual uptick in activity as borrowing costs decrease and consumer confidence stabilizes. While economic uncertainties remain, demand for housing in the GTA persists, particularly among first-time buyers and those looking to transition from condo living to freehold properties.

As we move into the spring market, all eyes will be on inventory levels, interest rates, and economic factors that will shape buyer behavior in the coming months. Buyers and sellers alike should remain informed and strategic in navigating the evolving landscape of Toronto’s real estate market.